On 1 October 2023, the Carbon Border Adjustment Mechanism (CBAM) entered into application in its transitional phase, with the first reporting period for importers ending 31 January 2024.

Climate change is a global problem that needs global solutions. As the EU rises its own climate ambition, and as long as less stringent climate policies prevail in many non-EU countries, there is a risk of so-called “carbon leakage”. Carbon leakage occurs when companies based in the EU move carbon-intensive production abroad to countries where less stringent climate policies are in place in the EU, or when EU products get replaced by more carbon-intensive imports.

The CBAM is a landmark tool to put a fair price on the carbon emitted during the production of carbon intensive goods that are entering the EU, aiming to reduce greenhouse gas emissions to 55% below the 1990 levels by 2030 and to encourage cleaner industrial production in non-EU countries. However, the proposal has faced scrutiny from partners like Africa, who question its impact on African exports, due to additional costs for exporters and deteriorating terms of trade.

The gradual introduction of the CBAM is aligned with the phase-out of the allocation of free allowances under the EU Emissions Trading System (ETS) to support the decarbonisation of EU industry.

By confirming that a price has been paid for the embedded carbon emissions generated in the production of certain goods imported into the EU, the CBAM will ensure the carbon price of imports is equivalent to the carbon price of domestic production, and that the EU's climate objectives are not undermined. The CBAM is designed to be compatible with WTO-rules.

Key Elements:

The CBAM will initially apply to imports of certain goods and selected precursors whose production is carbon intensive and at most significant risk of carbon leakage: cement, iron and steel, aluminium, fertilisers, electricity and hydrogen. With this enlarged scope, CBAM will eventually – when fully phased in – capture more than 50% of the emissions in ETS covered sectors. The objective of the transitional period is to serve as a pilot and learning period for all stakeholders (importers, producers and authorities) and to collect useful information on embedded emissions to refine the methodology for the definitive period.

The gradual phasing in of CBAM over time will also allow for a careful, predictable and proportionate transition for EU and non-EU businesses, as well as for public authorities. During this period, importers of goods in the scope of the new rules will only have to report greenhouse gas emissions (GHG) embedded in their imports (direct and indirect emissions), without making any financial payments or adjustments. Indirect emissions will be covered in the scope after the transitional period for some sectors (cement and fertilisers), on the basis of a defined methodology outlined in the Implementing Regulation published on 17 August 2023 and its accompanying guidance.

The Implementing Regulation on reporting requirements and methodology provides for some flexibility when it comes to the values used to calculate embedded emissions on imports during the transitional phase. Until the end of 2024, companies will have the choice of reporting in three ways: (a) full reporting according to the new methodology (EU method); (b) reporting based on an equivalent method (three options); and (c) reporting based on default reference values (only until July 2024). As of 1 January 2025, only the EU method will be accepted and estimates (including default values) can only be used for complex goods if these estimations represent less than 20% of the total embedded emissions. The Commission will publish default values by the end of 2023, well in time to contribute to the reports importers need to submit by the end of January 2024. This report from the EU's Joint Research Centre (JRC) will feed into the preparation of those default values.

The Commission has also developed dedicated IT tools to help importers perform and report these calculations, as well as in-depth guidance, training materials and tutorials to support businesses when the transitional mechanism begins. While importers will be asked to collect fourth quarter data as of 1 October 2023, their first report will only have to be submitted by the end of January 2024.

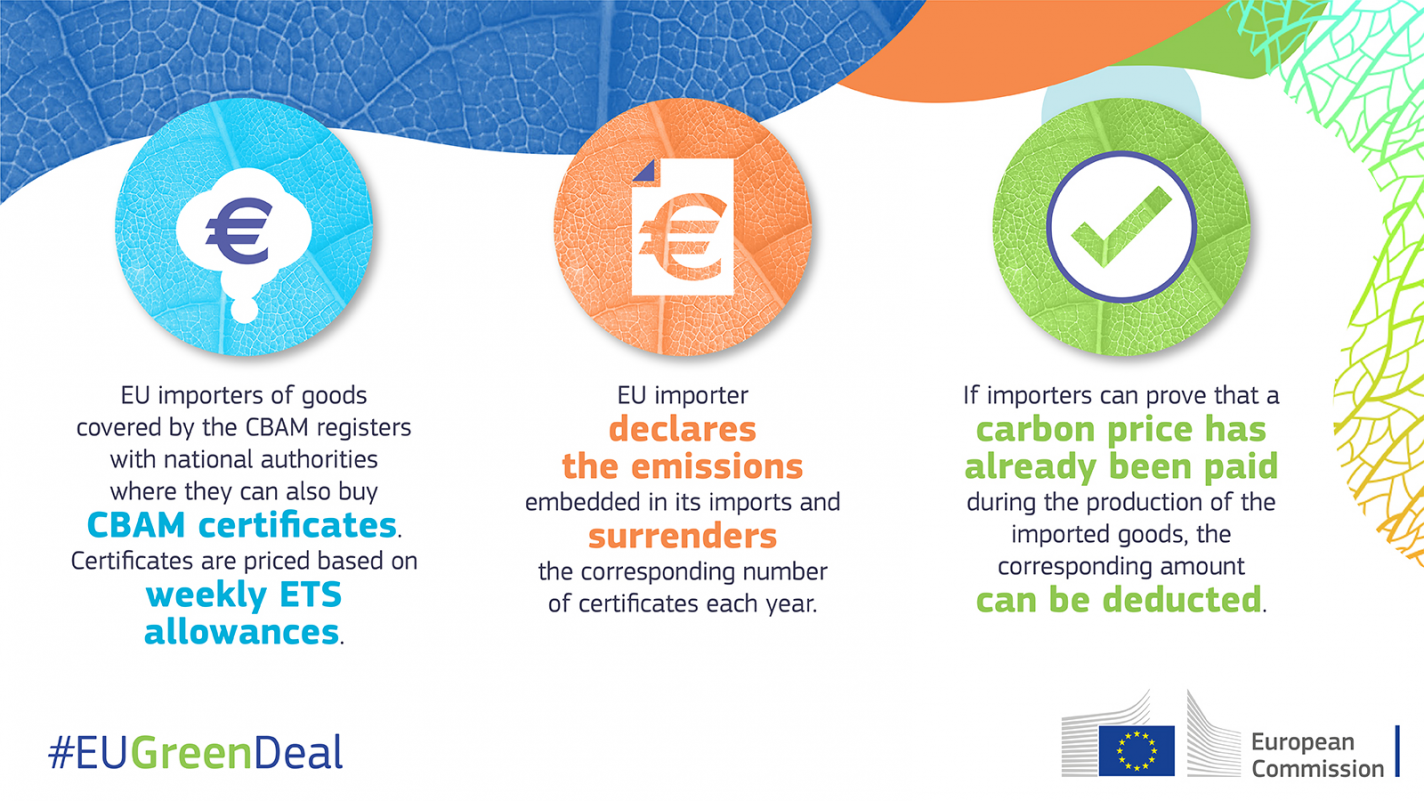

Once the permanent system enters into force on 1 January 2026, importers will need to declare each year the quantity of goods imported into the EU in the preceding year and their embedded GHG. They will then surrender the corresponding number of CBAM certificates. The price of the certificates will be calculated depending on the weekly average auction price of EU ETS allowances expressed in €/tonne of CO2 emitted. The phasing-out of free allocation under the EU ETS will take place in parallel with the phasing-in of CBAM in the period 2026-2034.

A review of the CBAM's functioning during its transitional phase will be concluded before the entry into force of the definitive system. At the same time, the product scope will be reviewed to assess the feasibility of including other goods produced in sectors covered by the EU ETS in the scope of the CBAM mechanism, such as certain downstream products and those identified as suitable candidates during negotiations. The report will include a timetable setting out their inclusion by 2030.

Source: European Commission